Re-imagining the Personal Lines Insurance – A touchless experience!

Insurance for a long time has been considered a slow moving and a very conservative industry. Some of it is because of the very nature of the industry which needs to be “risk-averse” and be the last hope of its customers when the situation so arises and also because of the fact that it is a highly regulated industry in every single country. But the conservative behemoth has started rolling towards a digital future and now that it is picking up the momentum, it is going to be a juggernaut.

This juggernaut and how it will shape up in future and what kind of changes will it bring is what I would like to explore and what this article is going to be about.

Digital and Business Transformation in Insurance

Like most industries, the rise of internet had profound impact on the insurance products were designed, packaged, sold, marketed and how the entire insurance lifecycle was managed. No aspect of Insurance has been left untouched by the digital revolution. This is across the value chain and in operations as well.

On one hand, the transformation is helping improve the customer experience and by extension customer stickiness, on the other hand, it is helping companies expand their portfolio to previous un/under-served segments and also is allowing it to save costs to help improve the Expense Ratio.

To illustrate some of the ways in which insurance is changing and also to highlight in ways it can further change, let’s go through the Policy life-cycle.

Policy Administration/Customer Onboarding

From the perspective of customers, this is their entry into the ecosystem of any company, the first interaction which will either lead them to becoming a paying customer or leaving it for a competition. This also happens to be area which has undergone the most visible change on ground.

The rise of Price Comparison Websites (Aggregators) has completely transformed the way customers shop for insurance. What was once an agent dominated field has almost entirely shifted to the Price Comparison Website. This not only resolved the asymmetry of information issue prevalent earlier but also allowed customers to quickly identify and shop based on the factors that they perceived were important (Price mostly!).

While this allowed a lot of customer churn for the insurers, this did come with advantages too. From the perspective of companies, it suddenly expanded their reach without the whole pain of expanding their agent network and in turn allowed them to choose and select the risk which they were comfortable with.

The next big change was adoption of omni-channel experience where Web+App played a big role. This is now playing a major role in introduction of new Telematics based insurance products which are also leading to the rise of Usage based insurance (Insurance in form of $/Km).

The above model has been in place for the better part of last decade and I believe it is ripe for disruption.

The next wave of transformation

The disruption is going to be led by following key technologies

- Image based data capture and analysis

- Commercial AI assistants – SIRI, Alexa, Google Assistant

- Telematics both in Auto and Health insurance

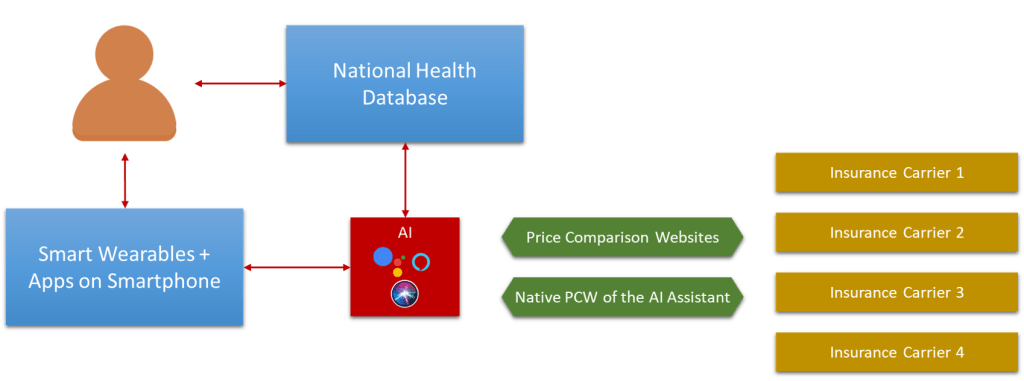

The future as represented in the diagram will essentially be the one where Human interaction will be mostly on providing consent to the AI assistant to search and index relevant data to be used for the Policy Purchase workflow. Relevant details of which are normally not available in day to day data being captured will need to uploaded once or if there are portals/apps which have this data then relevant authorisation will need to be provided.

To illustrate the specific use cases, following three Lines of businesses are highlighted here – Auto, Health and Property Insurance.

Auto Insurance

Insurers typically use following data to assess the underwriting risk associated with any policy.

- Demographic data of the driver/s

- Driving history of the driver/s

- Car/Bike details and history

- Geographic location of the Driver

- Typical usage/mileage

- Parking Locations

Most of the data currently is manually entered by the customer and few behind the scenes Data Enrichment integration used by the Insurance carrier. This need not be the case even now.

All the relevant data can in fact is directly access online or through relevant sensors without any manual intervention.

- Demographic Data, Driving history, Car Registration and history – All available online in one form or the other

- Home (Geographic) location – Available with all AI assistants

- Car usage and driving risk assessment – Raw data can be accessed through the “Connected Cars” and a third-party Risk assessment system can be created like the Credit Score system.

A very relevant example in this case is DigiLocker portal and app of Government of India. This is a single source of most of the Government issued documents and could be in future used to access data such as Vehicle Registration Details and Driver’s License. This would significantly ease the searching of policy process with most of the work being on selection of relevant coverages to be done by the user which can easily be done through voice-based commands or through UI.

Health Insurance

Smart wearables are revolutionising the field of Health Insurance. The trend started in 2014 with the rise of fitbit. Early on many of the insurance companies had identified the impact that this will have on the Health Insurance market.

There multiple start-ups and reward programs which are tying up with Health Insurance carriers to promote a healthy lifestyle and have introduced gamification along with monetary rewards to ensure that policyholders maintain a healthy lifestyle which directly promotes in reducing the claims expense of the carriers.

While this is one of the applications, this can in fact be taken a step further and along with the demographic data, the “Health Activity” data can be used by insurance carriers for the risk assessment. This data can be shared by AI assistants. The source of data can be one app or multiple apps depending on the usage. Almost all the apps actually do talk to each other even now and collation of data is pretty straightforward.

In addition to the activity data, national health databases such as NHS database in UK with the consent of user can be used by Health Insurance carrier for further assessment of risk. The database provides the user’s history of diseases and health concerns which is typically provided manually by the user at present. An AI assistant post authorisation can easily fetch this data through secured APIs and pass it to relevant carriers or PCWs. This helps both the user and the carrier as it leads to better risk assessment and also on user’s part reduces the chance of claim rejection on account of misrepresentation.

Property Insurance

Property insurance is trickier compared to the previous two but also one of the reasons why I have chosen it here for the use case. A property insurance is typically assessed for the risk based on following key criteria

- Location of the property

- Age and structural integrity of the property

- Fire hazard (insulation, fire alarm and water sprinklers)

- Theft hazard (Doors, Windows, lock types and locations)

- Flood hazard (vicinity to water)

- Valuation of the contents (if applicable)

Location of the property and the flood hazard can be assessed by the carrier using the geographic location of the property instead of relying on user assessing the risk through answering questions about vicinity of a water body. This can be done through satellite imagery and mapping of flood hazard. This can also be used to assess the theft risk of a given area through the crime/theft map.

Fire hazard and theft hazard can be assessed using pictures of the house which can then be used to extract relevant score on both fire and theft hazard. This will be easier and more accurate than user guessing about the details.

In addition, insurance carrier can remind policyholder about relevant inspections/maintenance such as Fire alarms and can keep tabs using images uploaded by the customer.

These are three of the examples of how AI, IoT and API based integration with third party sources can transform insurance where the user will be able to get quotes for any insurance product with ease and with vastly improved Customer Experience.

Threat to the existing business models

The changes are in motion and will threaten some of the existing players and may in fact change the way the business is done today.

Price Comparison Websites

PCWs are the Digital gatekeepers to the world of Insurance and for that matter most of the transactions online. They server a very important purpose where a user visits just one PCW and gets the quotes from the entire* market at one place. Network efforts played a big role in expanding the PCW market.

These network effects were mostly at a national level.

In the event where large digital players like Amazon, Google, Facebook enter this market and actually create their own PCW service (which they are already doing), the network effects will dictate that a large portion of the business will shift to these players. In addition, MNCs can have integration with these PCWs at a global scale allowing them to reduce the CAC (customer acquisition cost).

On top of this, in an AI led world, these will also be the first point of contact for user and a preference for the native PCWs can be promoted leading to stand-alone PCWs losing out.

Insurance Carriers

Insurance carriers will face two challenges in an AI enabled world which dominated by few AI assistants.

- Data ownership can allow companies operating AI assistants to squeeze insurance carriers for greater share of value created.

- Global PCWs can dictate terms to insurance carriers and may even end up designing their own insurance products

- Small insurance carriers may lose out to large insurance carriers on account small scale thus higher CAC which may end up either increasing cost of insurance or lowering the profit margin of the insurance carriers.

Data Protection/Privacy

In the world led by AI, the data will be the most precious commodity and there will all types of threat to privacy and also inducements to get ever increasing data.

The key moral and legal question will be about where to draw the line!

Conclusion

The AI is here to stay and it will change the way business is done almost everywhere. All players in the insurance value chain need to adapt and adapt now to ensure that they don’t end up losing in the AI race and are able to protect themselves. This will not always be easy or even apparent but the change is coming and it is coming fast.

One key element of this AI led policy search and purchase will be the trust in data. This will open a new field of Data Trust Score just like Credit score used for lending. This will be covered in the next article and how it is an excellent opportunity for someone to disrupt.

Pingback: Risk Reference Agency – Data Enrichment in the Touchless Insurance Era | Ashish Srivastav