Risk Reference Agency – Data Enrichment in the Touchless Insurance Era

Introduction

In my previous post, I had written about transforming the user experience in personal lines where the AI and AI-enabled Assistants such as SIRI, Alexa, Google Assistant and Cortana would be playing a major role in how we buy and manage the insurance policies.

I concluded the article with the need for a Risk scoring mechanism which can be used across multiple insurers just like Credit Scores are used currently for lending.

This article will focus on Data Enrichment used currently in the Insurance industry and how that can be extended to build a Risk Scoring mechanism for each Line of Business in insurance. I will also try to explore some of the key challenges that such a risk scoring mechanism will have to overcome to become acceptable by all. The article here will have more of UK focus but in principle applies to all geographies.

Data Enrichment in Insurance

The bedrock of the Insurance industry is its ability to correctly identify and assess the risk using, which they can then underwrite it. This decides the profitability and ability of the business to remain solvent. Even a few percentage points increase in Claim Frequency and the average claim amount can wipe off the entire loss reserve of any carrier.

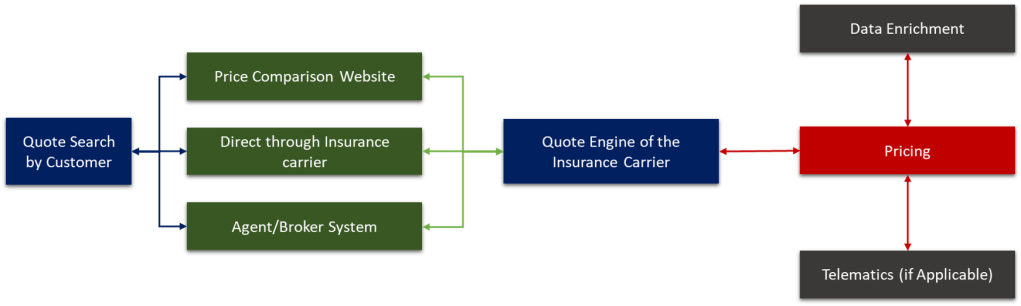

This risk assessment is a critical decision, and in personal lines insurance has to be taken in a few seconds for each quote. This is where Data Enrichment helps insurance companies make the decision. The following are typically validated through Data Enrichment.

- Identity and Address

- Credit Score and history

- Convictions and Legal history

- Claims and Underwriting Exchange (CUE)

- Motor Insurers Anti-Fraud and Theft Register (MIAFTR)

- No Claims Discount

- DVLA (license and vehicle history)

This is not an exhaustive list and there are multiple other checks performed by insurance companies as part of the Data Enrichment process. Using this data, the insurance carrier decides if it wants to underwrite the risk and if so at what premium.

These Data Enrichment services are provided by Third Party companies who specialize in their respective areas. Of these, the two which are of interest to the topic at hand are –

- Credit Score (including identity check) provided by the three CRA in The UK (Experian, Equifax and TransUnion)

- CUE, MIAFTR and NCD provided by MID (Motor Insurance Database)

These are interesting as they are essentially industry collaborations whereby companies share data. This is used to validate the correctness of data provided by a user and to identify any markers of a high-risk customer including but not limited to bad Credit History, Claim Fraud, Conviction etc.

Risk Reference Agency

The Data Enrichment mechanism uses a lot of indirect markers to identify risk. A lot of them are based on correlations rather than causations. Also, CUE/NCD promote drivers to not report small/minor claims to prevent the future increase in premium. This certainly helps improve the small claims performance of insurance carriers but in my view prevent companies from getting the full picture. A history of multiple incidents represents a high probability of a serious incident in future leading to the exponentially higher claim.

This necessitates that insurance carriers enrich data using the actual behaviour of the customer and not just rely on indirect markers. This is where Telematics and wearables come into play. Currently, a lot of individual companies are offering Telematics based insurance for both Auto and Health lines of business.

These individual attempts at using Telematics/Wearables/Sensor-based data to improve risk management are commendable and are a great business proposition as well. What is missing is an eco-system where this data can be ported from one insurance carrier to others. Currently, each insurance company keeps the data to itself which is understandable as it helps become more competitive. The downside in Motor insurance is that only young drivers and new entrants to the UK use Telematics based policies to keep insurance low and shift to the “normal” policies as soon as the price difference lower to negligible.

This harms Telematics in long run as the temporal shifts in the driving behaviour can’t be captured leading to again reliance on correlation for risk assessment. Besides, the good driving behaviour which was being promoted through the use of Telematics is lost.

On the driver side, the premium is the most important decision factor and shopping around at the end of the policy term is the best way to get a lower premium. As their current score can’t be taken elsewhere, there is no reason for them to continue with Telematics with the new policy. Even if they opt for it, they will start at the bottom and will have to again build a good score with the new company to be able to take the best advantage of the policy.

The only way this can be prevented is by having a mechanism by which the Behaviour score can be ported between insurance carriers. This need not be the entire data but more like key metrics to come to a unified score identified across the insurance market. In the next section, I have outlined the critical factors which can help propel it forward and the challenges that will come along the way.

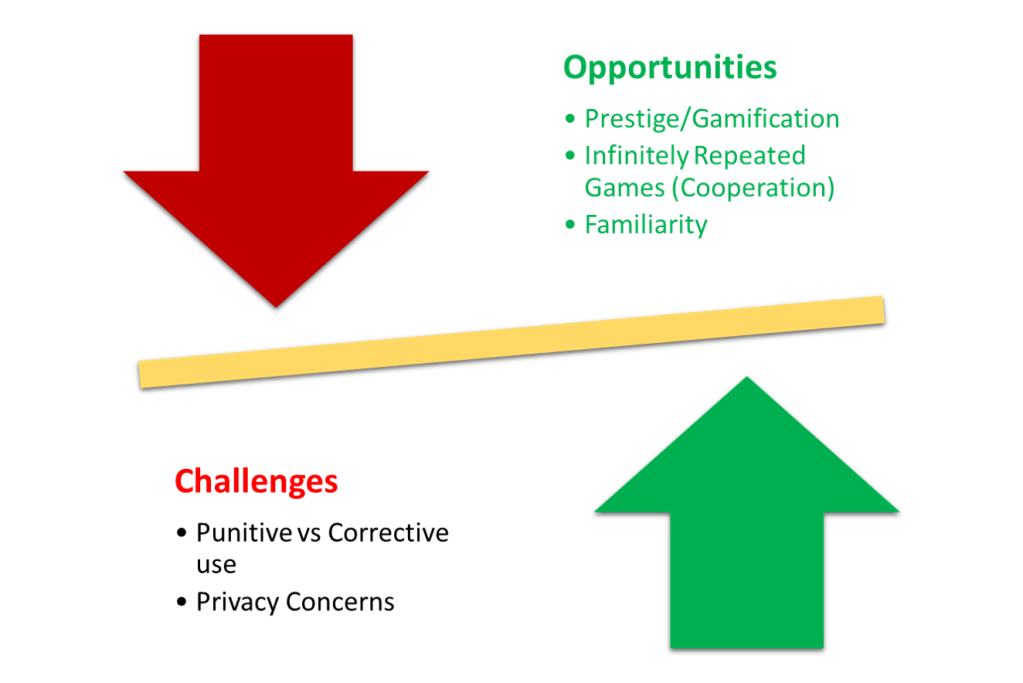

The factors in favour of a Risk Reference Agency

Familiarity

One of the biggest factors in favour of the Risk Reference Agency (RFA hereon) is that people are already accustomed to a similar concept in form of Credit Reference Agencies and thus are both aware and accustomed to the concept.

Game Theory

Apart from the familiarity, the RFA introduces the concept of Infinitely Repeated Games to the Insured-Insurer relationship. In an Infinitely repeated game, the game theory dictates that parties benefit from cooperation and that any non-cooperative or selfish behaviour is/must be punished to ensure future cooperation.

Without RFA, Insurance is a finite game where both parties can exit the game at the end of the term. In this type of game one party (Insurer) wants to get as much data as possible whereas the other party (Insured) tries to limit data as much as possible.

The NCB brought in the element of repeated games to Insurance, with RFA it takes it further and incentivises the Insured to divulge data to the Insurer. In turn, it incentivises Insurer to use data to better tailor the product and give better premium rates to the insured.

As this RFA score can be used beyond one Insurer, both parties are continuously incentivised to improve Premium offerings and driving behaviour respectively to help improve the outcome.

Prestige/Competition

This brings in the element of Gamification to the RFA concept, this is applicable at the Insurer level and also at the overall market level.

An absolute score is great but along with a relative score which helps identify individuals in their relative ranking in the overall population can and will make it competitive to become a safer driver. This of course needs to be incentivised by specific promotions, public recognition, monetary rewards and better premiums. The prestige that comes with the achievements must be allowed to be publicly displayed on key social media platforms to further incentivise the behaviour.

Challenges to the Risk Reference Agency

Having discussed the factors in favour of the RFA, it is also important to discuss the challenges that must be addressed to the concept of RFA.

Data Privacy

One of the biggest challenges to the RFA is going to be the concerns around data privacy. It is very important that any data being captured is clearly outlined and is clearly communicated to the customers and they must have full rights to know what is being captured at any given point of time.

Also, it is important that data being shared to Insurers is limited to risk scores and some specific details and is not excessively intrusive. Else, the privacy concerns will override any potential benefit from RFA.

Length of Data Retention

The RFA can be used as an Incentivising factor to help improve driving or can be used as a punitive factor to help punish bad driving.

A combination of both is important but it is necessary to define the temporal scale or temporal impact of past issues. If an old mistake overshadows the better current driving behaviour then there are high chances of reversion to old habits as there is no incentive to continue with better driving behaviour. This will require the scale to be dynamic and must limit the score to be from a dataset of at max last 5/6 years.

This is also important as all drivers go through a learning curve and their behaviour changes depending on the individual and family circumstances and age. Thus a very old data/score may not be very relevant to the current risk score.

Conclusion

The rise of InsurTechs and the Telematics driven insurance has opened up space for a paradigm shift in how insurance will be sold and bought. To bridge the asymmetry of information and trust gap in this Data-driven world, the Risk Reference Agencies will play a crucial role and it is only a matter of time for them to start in some shape and form.